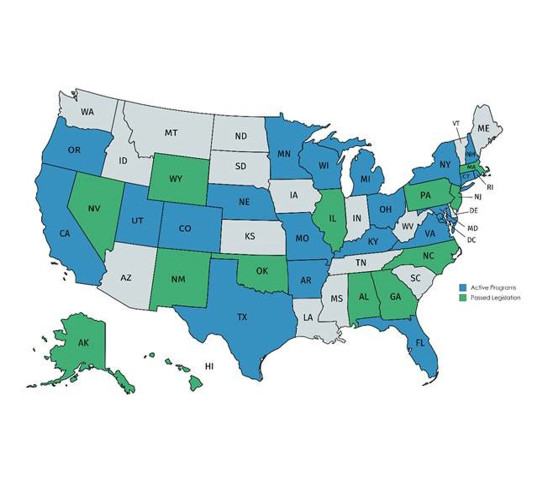

HTC UpdateCalifornia Historic Tax Credit

California now has a state historic tax Credit SB 451 authorizes a California state historic tax credit beginning January 1, 2021 with a sunset date of January 1, 2026. The annual program cap will be $50