In the KnowOpportunity Zones 101

We are excited to share this guest commentary from Christine Johnston of MarksNelson Certified Public Accountants.

We asked Christine about Opportunity Zone investment incentives. Created by the 2017 federal Tax Reform bill, this incentive allows investors to defer and reduce capital gains taxes by re-investing in certain distressed census tracts. New Missouri historic tax credit legislation also dedicated a portion of overall state historic tax credit funding to distressed census tracts.

- How are Opportunity Zones determined?

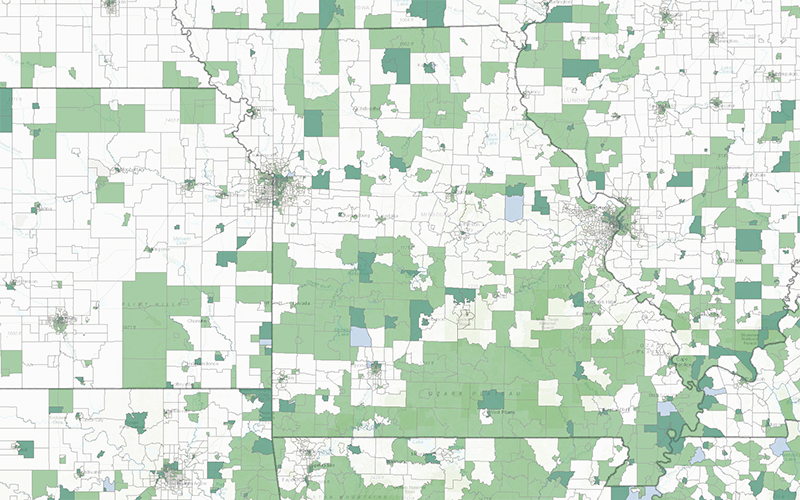

Each state’s Governor nominates selected locations (Census tracts) that will be eligible for the capital investments. The current list of approved Zones are shown on the Department of the Treasury Community Development Financial Institutions Fund website.

- Who can invest?

Individuals or corporations that have transactions that will result in capital gains can elect to defer paying taxes on the gain by investing in Opportunity Zone Funds. The longer they stay in the investment, the longer they can defer the gain and tax payment. Staying in even longer can reduce part of the gain recognition all together.

- What is an Opportunity Fund?

A Qualified Opportunity Fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is located in an Opportunity Zone and that utilizes the investor’s gains from a prior investment for funding the Opportunity Fund.

- How do I identify an Opportunity Zone Fund?

To become a Qualified Opportunity Fund, an eligible taxpayer self certifies. (Thus, no approval or action by the IRS is required.) To self-certify, a taxpayer merely completes a form included with their tax return.

The Benefits

5-year option: Temporary deferral and step up : – Defer paying tax on the capital gains for 5 years by staying invested in the fund, but must pay tax on the gain by earlier of date investment is disposed of or 12/31/26. A step up in basis (reduction in taxable gain amount) of 10% is earned if held for at least 5 years.

7-year option: Temporary deferral and larger step up: – Defer paying tax on capital gains by staying invested for 7 years or more. A step up in basis (reduction in taxable gain amount) up to 15% of the amount invested is earned.

10-year option: Permanent exclusion with larger step up: – If investment is held for 10 years or more, then a complete exclusion of the gains accrued after investing in the fund is earned plus the 15% reduction in the gain recognized by holding the investment for 7 or more years.

Census tracts are shown on the Department of the Treasury Community Development Financial Institutions Fund website.